New York State Surcharge Law

How To Save Thousands

Be In Compliance With Dual Pricing

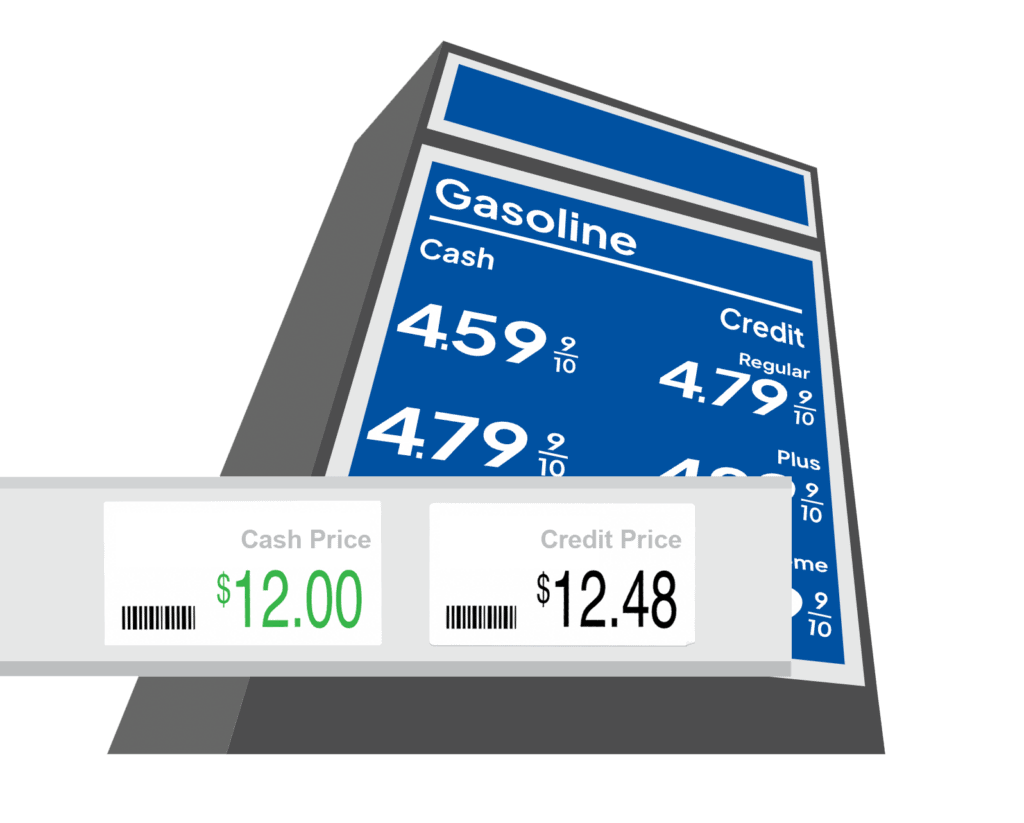

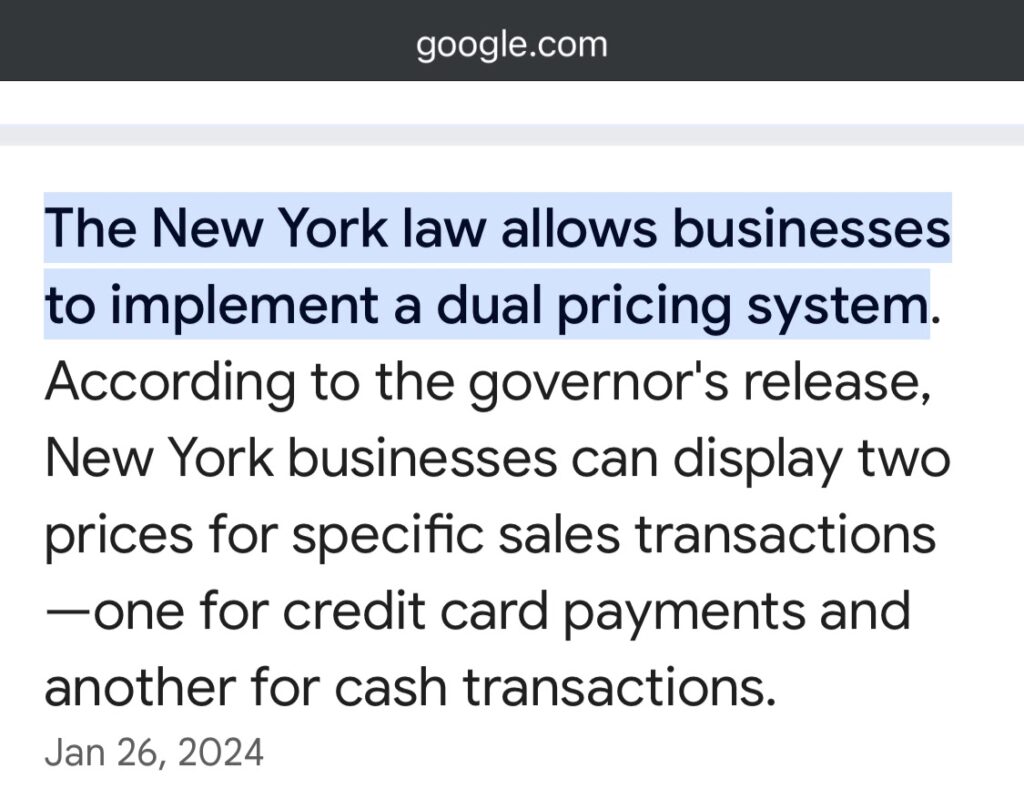

Many NY business owners are unclear when it comes to surcharging ( surcharge ) payment processing for credit card processing acceptance. The New York State Law allows businesses to surcharge if it is done with full transparency displaying both card and cash transaction prices.

🛑 However, a business owner may NOT surcharge for debit card transactions. 🛑

✅ Our Dual Pricing solution shown below solves this problem 100% by stepping out of the surcharging parameters set forth by NY State and utilizing a dual pricing system instead. ✅

☎️ Call / Text Anytime: 801-205-1955.

See How Our Free Dual Pricing Payment Machines Interact

Debit Card Issue With The New Law:

🛑 Debit Card Exclusion 🛑

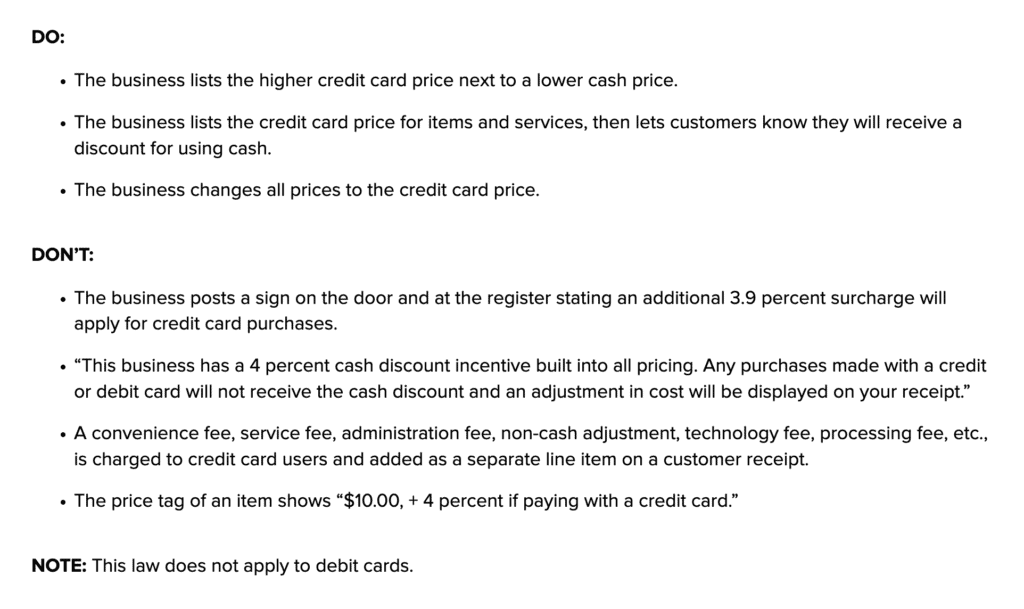

The screenshot is directly from the official website of New York State posted on it’s website all about the new credit card surcharge law. On the bottom left we read, NOTE: This law does not apply to debit cards.

What that being said, business owners are still being charged for running debit card transactions but not as much. So will they need to post three prices? 🤔

Also, most if not all digital dual pricing credit card machines and pos systems these days only show card and cash prices for customers to choose just like gas stations. 🤔

Solution To Debit Card Exclusion:

✅ Offer Customers Dual Pricing Instead of Surcharge ✅

By using a surcharge or surcharging as it is often called pricing strategy, debit cards can not be treated the same as credit cards. This is due to the fact as a merchants business is charged less according to the Durbin Amendment passed in 2010.

Using a dual pricing model like gas stations, with card and cash pricing, merchant step out of the restrictions of a surcharge pricing model.

Recommended 4% Surcharge Issue With The New Law:

🛑 Visa Surcharge Cap Is At 3% 🛑

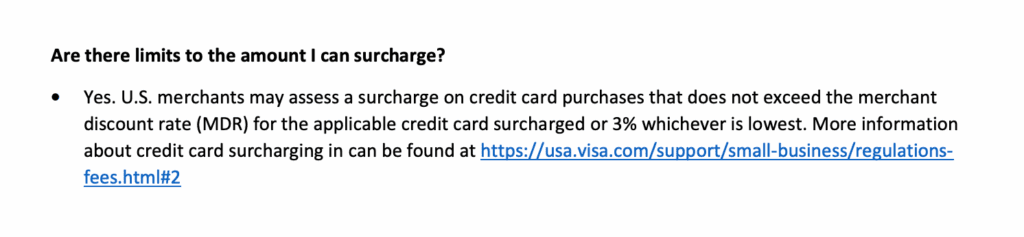

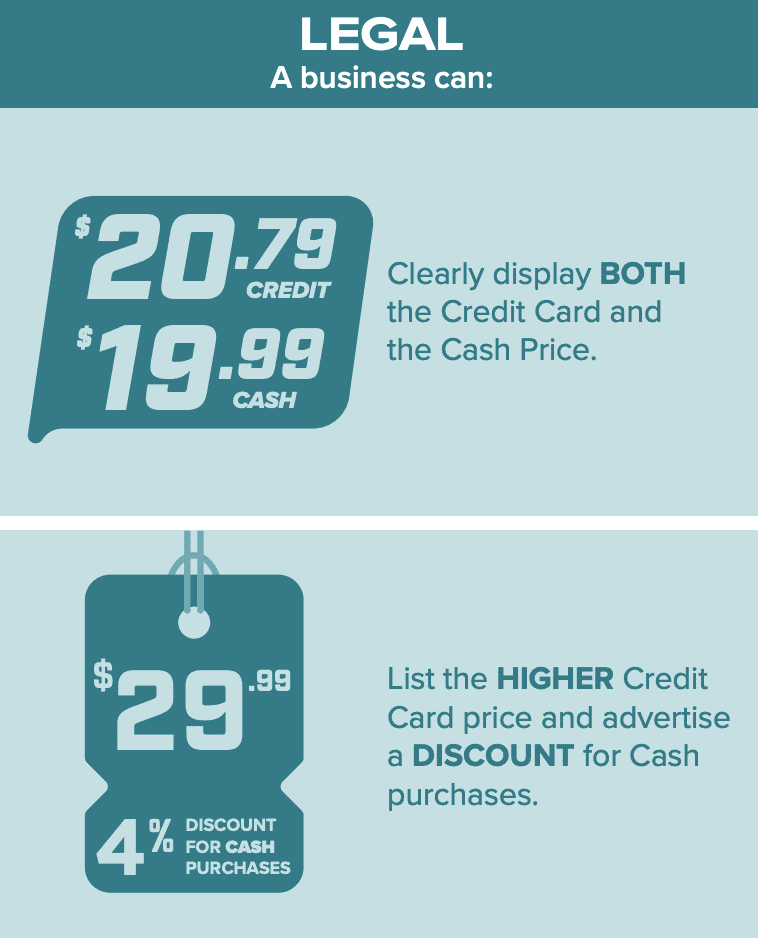

Posted in green is a screenshot directly from New York State website regarding price labeling to be in compliant with the states surcharge law. Here NY State is allowing business the opportunity to charge and or surcharge as much as 4%. Well that is fine if your customer hands you a Mastercard, however with Visa the legal limit is only 3%.

Here is a screenshot directly from Visa showing the maximum allowed for surcharge or surcharging is capped at 3%. How to small business owners solve this problem?

Solution To The Visa Surcharge of 3%:

✅ Utilize Dual Pricing Dual Pricing As Seen Across The US ✅

Step out of the Surcharging pricing model into the Dual Pricing model. New York State customers see the dual pricing approach displayed at gas stations. Now small business can also offer the same to offset payment processing fees. Not only in price tagging, but by displaying Dual Pricing on their card payment processing machines as well.

Dual Pricing Is Legal Across The Country

✅ New York EZ Pay offers a solution that is legal in all 50 states. This is called Dual Pricing. NY EZ Pay will show you how to implement this benefit with our Dejavoo digital credit card acceptance machines.

✅ Now when a Dual Pricing transaction total is displayed, your customer will have the visible choice to tap card or cash. This digital customer facing Dual Pricing approach provides the NY required 100% transparency.

Surcharge / Dual Pricing Will Save Your Business

Based on a 4% Rate Savings, Dual Pricing Brings Your Monthly Statement Bill to Zero.

Just do the math.

| Mo Card Volume: | Mo Savings | 1 Year Savings | 5 Year Savings |

|---|---|---|---|

| $5,000 | $200 | $2,400 | $12,000 |

| $10,000 | $400 | $4,800 | $24,000 |

| $20,000 | $800 | $9,600 | $48,000 |

| $50,000 | $2,000 | $24,000 | $120,000 |

| $100,000 | $4,000 | $48,000 | $240,000 |

| $250,000 | $10,000 | $120,000 | $600,000 |

| $500,000 | $20,000 | $240,000 | $1,200,000 |

How Our Free Dual Pricing Payment Machines Work

Our Dejavoo dual pricing card machines will display the credit price like it’s a non cash transaction to begin with. EX: a $100 charge will show as $104. The next morning $100 is deposited into your business checking account. Clean and simple.

Businesses using Dual Pricing do not receive any part of the 4% fee as it is the assumed full price.

New York EZ Pay offers NY businesses our Dejavoo Dual Pricing payment processing machines. This smart device shows both cash and credit card prices every time a transaction total is displayed. We will help set all of this up for your business making it easier than ever to accept Dual Pricing and save thousands every month.

✔️ No Contract

✔️ Free Machine

✔️ Next A.M. Funding

☎️ Call / Text Anytime: 801-205-1955.

Our New York Surcharge Dual Pricing Solution

✔️ NO

Contract

✔️ Next

A.M. Funding

✔️ NO

PCI Fees

✔️ Free

Machine

Just imagine if you did not have to pay processing fees anymore, how much this would save and increase your bottom line. A lot, right! We offer a digital smart payment acceptance solution for your business that will eliminate 90%+ of your fees. Imagine how much your business will be saving year after year.

Enjoy Eliminating:

√ Processing Fees

√ Statement Fees

√ Per Item Fees

√ PCI Fees

√ Batch Fees

Enjoy Experiencing:

√ Next Am Funding.

√ Simplified Statement

√ No Contract

√ No Cancellation Fees

√ Free Smart Processing Machines

As Per New York State Law:

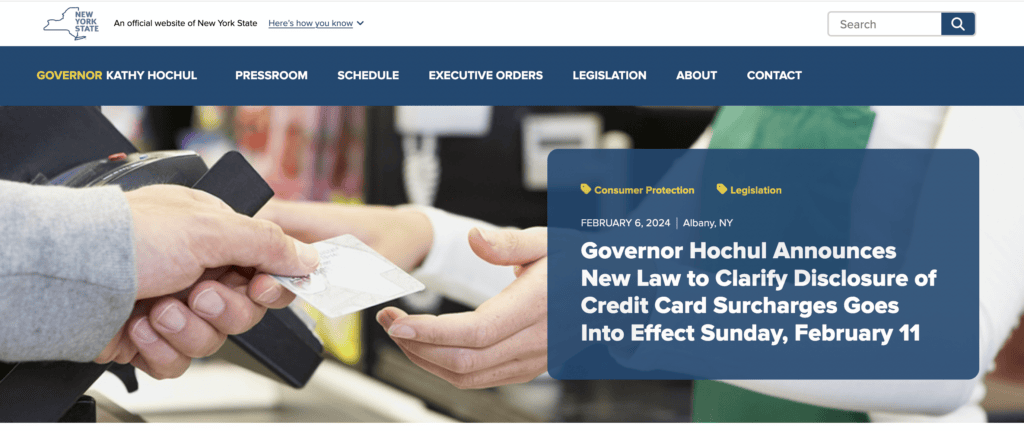

This is an image directly from the New York State website as I have provided a direct link above. Look closely what they recommend, and then look at what NY EZ Pay is offering as a solution. Looks like Dual Pricing to me.

New York State Surcharge Law Web Links:

Governor Hochul Signed into Law in December 2023 for Greater Consumer Protections and More Transparency. Business Transactions Imposing a Credit Card Surcharge Must Post Total Price of Transactions, Including Surcharge, Prior To Sale. This is also called Dual Pricing.

To Assist Businesses, the Department of New York State has Created a Credit Card Surcharge Guide and Video to Help Businesses Comply with the Law.

Web Links – New York Surcharge Law:

The New York Surcharge Law articles below are worth the read as they outline credit card surcharging and transparency in price labeling.

We have all observed Gas Stations displaying two prices, one for cash and another for credit card, so we are already familiar with Dual Pricing. This is a common pricing strategy that gives customers the choice to pay with cash instead of a credit card offering separate prices for both.

As of February 11, 2024, new law New York, establishing limits and rules for surcharging. Enacted in December 2023, the new statute has a price disclosure component, detailing how surcharge prices are communicated to customers.

Our understanding may contain errors, omissions, or inaccuracies, and should not be relied on as authoritative information or legal advice.

Get Our New York Dual Pricing Credit Card Machine Today

Be in compliance with New York State Surcharge Law with our Dual Pricing Payment Processing by New York EZ Pay. This is a brilliant way to save thousands on payment processing fees. Get double support not only from NAB on the 1-877 corporate level, but also yours truly on the local NY level. Greg G. Kapitan. You can call or text me at: 801-205-1955 anytime.

We hope to hear from you ASAP.

Greg G. Kapitan founder of NY EZ Pay pictured with my wife Michelle.