New York State Surcharge Law

Save Thousands With Dual Pricing

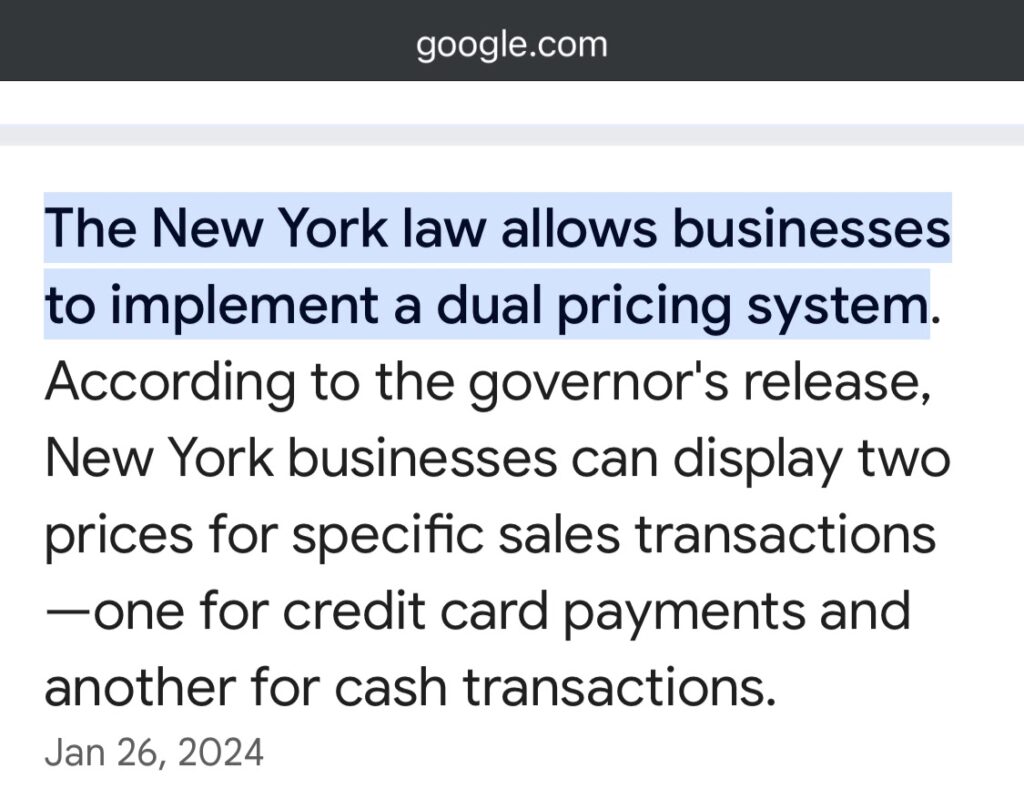

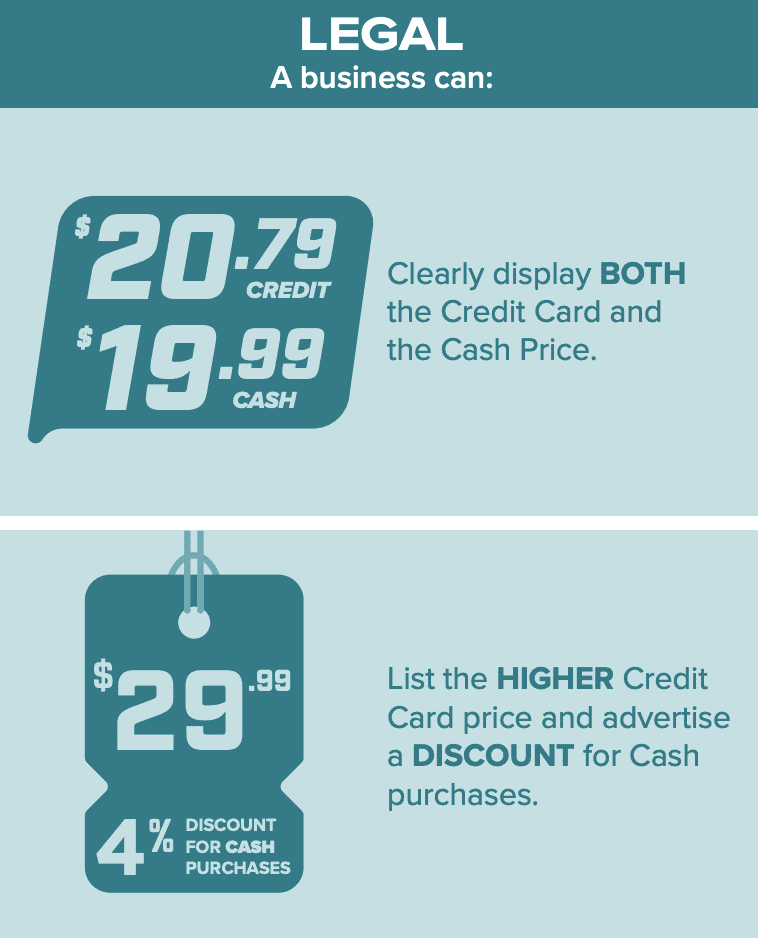

Many New York business owners remain uncertain about the rules surrounding surcharging for credit card transactions. While New York State surcharge law does permit surcharging, it must be implemented with complete transparency, meaning both cash and credit card prices must be clearly displayed. This is at the point of sale and in price tagging.

Hello, I am Greg G Kapitan from NY EZ Pay / iSmart Payments (seen below).

☎️ Call / Text Anytime: 801-205-1955.

See How Dual Pricing 4% and 3% Payment Machines Interact

Dual Pricing Seen Across The Country

✅ Utilize Dual Pricing Dual Pricing As Seen Across The US ✅

Transition from Surcharging to Dual Pricing.

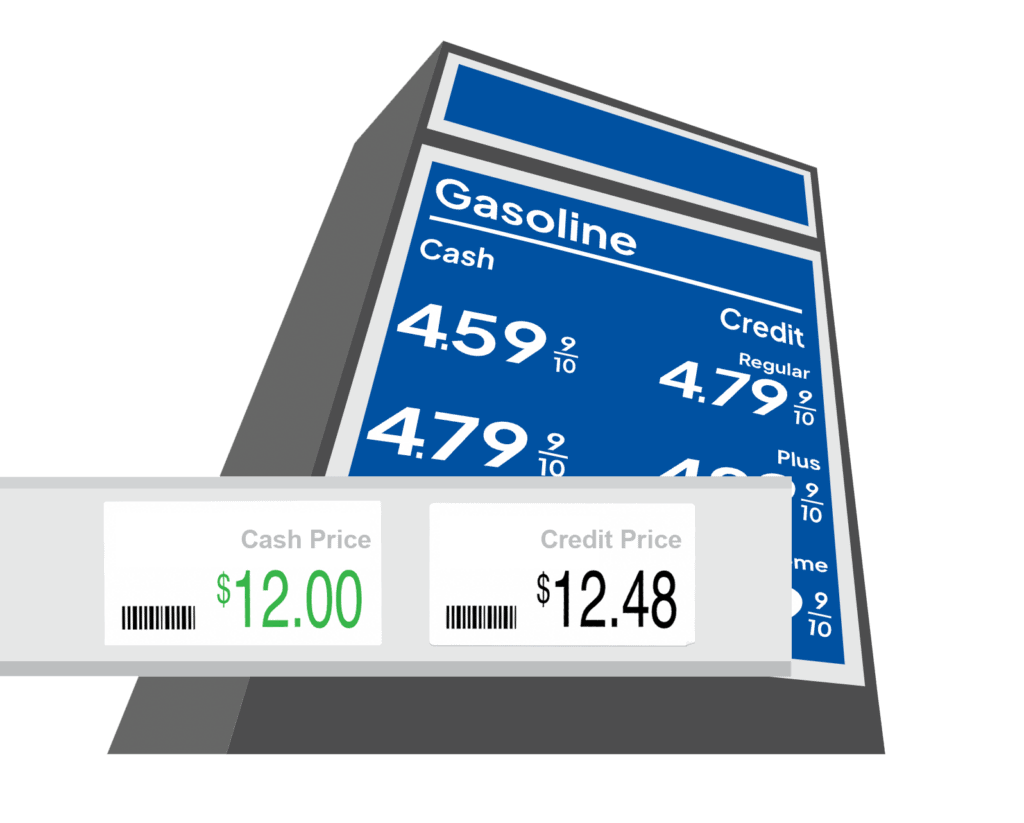

Move beyond the traditional surcharging model and adopt a compliant, customer-friendly dual pricing approach. In New York State, consumers are already familiar with this model at gas stations, where both credit and cash prices are clearly displayed.

Now, small businesses can leverage the same strategy to help offset payment processing fees—while maintaining transparency and trust. Dual pricing can be reflected not only on product labels but also directly on your card payment terminals, giving customers clear, real-time pricing options at checkout.

Dual Pricing Is Legal Across The Country

Dual Pricing Made Easy with New York EZ Pay

New York EZ Pay offers a fully compliant payment solution that is legal in all 50 states—Dual Pricing. Our team will guide you through the seamless implementation of this model using our advanced Dejavoo digital payment terminals.

With Dual Pricing, transaction totals are clearly displayed, giving your customers a transparent choice between paying by credit card or cash. This customer-facing digital display ensures full compliance with New York Surcharge Law for transparency requirements, while helping your business manage payment processing costs effectively.

New York Surcharge Law/ Dual Pricing Save Your Business:

Based on a 4% Rate Savings, Dual Pricing Brings Your Monthly Statement Bill to Zero.

Just do the math.

| Mo Card Volume: | Mo Savings | 1 Year Savings | 5 Year Savings |

|---|---|---|---|

| $5,000 | $200 | $2,400 | $12,000 |

| $10,000 | $400 | $4,800 | $24,000 |

| $20,000 | $800 | $9,600 | $48,000 |

| $50,000 | $2,000 | $24,000 | $120,000 |

| $100,000 | $4,000 | $48,000 | $240,000 |

| $250,000 | $10,000 | $120,000 | $600,000 |

| $500,000 | $20,000 | $240,000 | $1,200,000 |

How Our Free Dual Pricing Payment Machines Work

New York EZ Pay proudly offers Dejavoo Dual Pricing payment terminals—a smart, transparent solution for New York businesses looking to reduce processing costs while staying compliant with the State surcharge law.

With our system, card transactions are treated as non-cash payments and clearly display the card price at the point of sale. For example, a $100 purchase will appear as $104 ($ 103 also available) when paid by card. The next business day, $100 is deposited into your business checking account—clean, simple, and efficient.

Our Dejavoo devices automatically present both cash and card pricing with every transaction, giving your customers a clear and compliant choice. Businesses using Dual Pricing do not keep any portion of the surcharge—it is included in the assumed total price. A 4% – 3% fee structure is also available based on your preference.

We handle the full setup process, making it easier than ever to implement Dual Pricing and start saving thousands each month.

✔️ No Contract

✔️ Free Machine

✔️ Next A.M. Funding

✔️ No PCI Fees

☎️ Call / Text Anytime: 801-205-1955.

As Per New York State Surcharge Law:

This is an image directly from the New York State website as I have provided a direct link above. Look closely what they recommend, and then look at what NY EZ Pay is offering as a solution. Remember to post both card and cash prices and enter the cash price into our credit card machine.

New York State Surcharge Law Web Links:

Governor Hochul Signed into Law in December 2023 for Greater Consumer Protections and More Transparency. Business Transactions Imposing a Credit Card Surcharge Must Post Total Price of Transactions, Including Surcharge, Prior To Sale. This is also called Dual Pricing.

To Assist Businesses, the Department of New York State has Created a Credit Card Surcharge Guide and Video to Help Businesses Comply with the Law.

Web Links – New York Surcharge Law:

The New York Surcharge Law articles below are worth the read as they outline credit card surcharging and transparency in price labeling.

We have all observed Gas Stations displaying two prices, one for cash and another for credit card, so we are already familiar with Dual Pricing. This is a common pricing strategy that gives customers the choice to pay with cash instead of a credit card offering separate prices for both.

As of February 11, 2024, new law New York, establishing limits and rules for surcharging. Enacted in December 2023, the new statute has a price disclosure component, detailing how surcharge prices are communicated to customers.

Our understanding here at NY EZ Pay may contain errors, omissions, or inaccuracies, and should not be relied on as authoritative information or legal advice.

Get New York Surcharge Law Dual Pricing Credit Card Machine

Be in compliance with New York State Surcharge Law with our Dual Pricing Payment Processing by New York EZ Pay. This is a brilliant way to save thousands on payment processing fees. Get double support not only from North on the 1-877 corporate level, but also yours truly on the local NY level. Greg G. Kapitan. You can call or text me at: 801-205-1955 anytime.

We hope to hear from you ASAP. Greg G. Kapitan founder of NY EZ Pay pictured with my wife Michelle.

Disclaimer: This page is for informational purposes only and does not constitute legal advice.